Clean Harbors Announces Closing of Eveready Acquisition and Second Quarter Financial Results

| | Company Updates 2009 Guidance and Announces Plans for New Segment Reporting | ||

| | Eveready CEO Rod Marlin Joins Clean Harbors’ Board of Directors |

Norwell, MA – August 3, 2009 – Clean Harbors, Inc. (NYSE: CLH), the leading provider of environmental and hazardous waste management services throughout North America, today announced that on July 31, 2009, it completed its previously announced acquisition of Eveready Inc. (TSX: EIS), a Canadian-based company that provides industrial maintenance and production, lodging, and exploration services to the oil and gas, chemical, pulp and paper, manufacturing and power generation industries. Clean Harbors also announced its financial results for the second quarter ended June 30, 2009.

Clean Harbors acquired 100% of Eveready’s outstanding common shares in exchange for USD $56 million of available cash, USD $118 million in Clean Harbors’ common stock consisting of 2.4 million shares, and the assumption of approximately USD $235 million of Eveready debt. Excluding all one-time fees and acquisition-related expenses, Clean Harbors expects the acquisition will be accretive in the first full quarter of combined operations.

“This transaction sets a strong foundation for our growth in the years ahead,” said Alan S. McKim, Chairman and Chief Executive Officer. “Eveready brings to Clean Harbors an outstanding combination of talented people and valuable assets that substantially extends our capabilities in both the environmental and industrial services marketplace. We anticipate considerable cross-selling opportunities for our combined organization as we greatly expand the range of services we can now offer customers of both companies. The acquisition also significantly broadens our geographic footprint and increases our presence throughout Canada.”

“Culturally, we believe our two organizations are a great match,” McKim said. “Our ability to complete the acquisition on schedule is a testament to the hard work of both teams, who have worked tirelessly since this past Spring to rapidly bring this deal to a close. Based on our experience with prior acquisitions, we anticipate quickly integrating Eveready’s portfolio of assets and beginning to capture the significant upside potential we envision from the combined company.”

“Our integration team has already begun identifying where we believe we can reduce costs, optimize utilization of our combined assets and streamline our back-office and administrative functions by bringing Eveready’s disparate systems onto our unified platforms,” McKim said. “Through some reductions in redundant headcount, economies of scale in procurement and the implementation of our industry-leading processes, we expect to realize approximately $15 million in synergies in 2010 and an additional $5 million in synergies in 2011.”

Board of Directors Appointment

Clean Harbors also announced today the appointment of Rod Marlin, Eveready’s President and Chief Executive Officer, to Clean Harbors’ Board of Directors, which now has ten members including Mr. Marlin. Mr. Marlin has been actively involved with Eveready since 1995 and was the company’s President and Chief Executive Officer since 2002. “Rod’s deep understanding of the Canadian environmental and industrial services marketplace will be invaluable to Clean Harbors as we embark on this next phase of our growth,” McKim said. “We are strengthening our Board with this appointment, and we look forward to benefiting from Rod’s counsel.”

Second-Quarter Financial Results

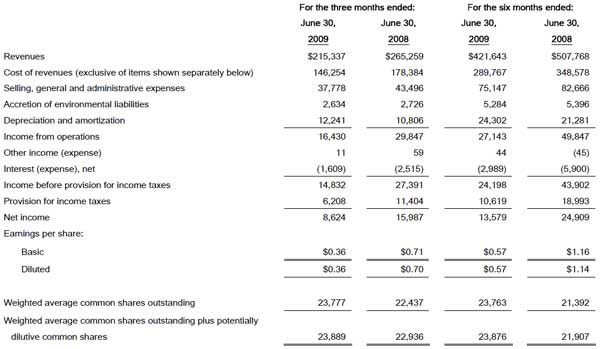

For the second quarter of 2009, Clean Harbors reported revenue of $215.3 million compared with $265.3 million in the second quarter of 2008. Income from operations was $16.4 million compared with $29.8 million in the second quarter of 2008. Second quarter 2009 net income was $8.6 million, or $0.36 per diluted share, compared with $16.0 million, or $0.70 per diluted share, in the second quarter of 2008. Second quarter 2009 income from operations was reduced by approximately $3.3 million in expenses related to the Company’s acquisition of Eveready. Weighted average diluted shares outstanding used to calculate the net income per share in the second quarter of 2009 were 23.9 million, versus 22.9 million in the second quarter of fiscal 2008.

EBITDA (see description below), which also was reduced by the $3.3 million in acquisition-related expenses, was $31.3 million compared with $43.4 million in the second quarter of 2008.

“While we experienced a sequential increase in revenue from the first quarter, our second-quarter performance fell short of our expectations as the challenging economic conditions continued to weigh heavily on several areas of our business,” said McKim. “Specifically, our results were affected by a number of factors including project delays by customers; ongoing weakness within our chemical, manufacturing and utilities verticals; and limited emergency response work.”

“Within our Technical Services segment, our results for the quarter were mixed,” McKim said. “Utilization during the quarter at our incineration facilities, which includes most of the 50,000 tons of capacity added in the past year, was 88%, consistent with the prior year level. Landfill volumes were up 10% year-over-year, although down from first-quarter volumes as a result of the significant reduction of project work. Our TSDF locations and general labor and transport business saw an overall decline as a result of the ongoing slowdown in certain industry verticals. A bright spot within Technical Services during the second quarter was our solvent recovery business, which continues to be a steady contributor. We made some enhancements to our Ohio facilities during the quarter to further capitalize on our momentum in this area. In addition, we remain on track with the second phase of our solvent recovery plant expansion at our El Dorado location, which we anticipate will be completed by the first quarter of 2010.”

“Within Site Services, we experienced a steep drop-off in projects, particularly from our petrochemical, specialty chemical, manufacturing and utilities clients, which are continuing to conserve their capital,” said McKim. “The silver lining to this shortfall is that the vast majority of these projects have been delayed rather than cancelled, and we are beginning to see a pick up in activity this quarter.”

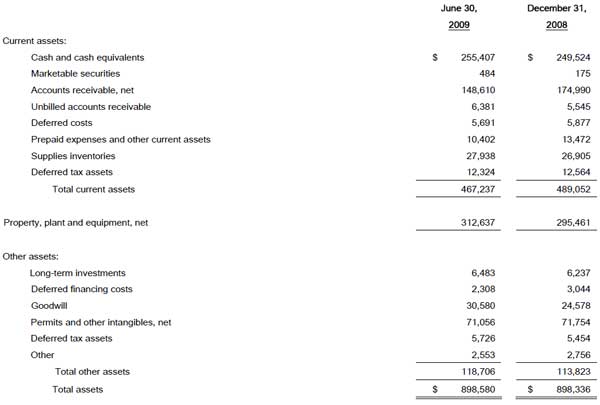

“Despite the revenue shortfall, our ongoing cost control initiatives enabled us to generate relatively healthy EBITDA margins of 14.5%. If we exclude acquisition-related costs, our EBITDA margin would have exceeded 16%. In light of the challenging near-term environment, we continued to right-size our organization, and have reduced our non-billable headcount to its lowest level in several years,” McKim said. “We also continued to maintain a healthy balance sheet and strong capital position. We closed the second quarter with cash and equivalents of more than $255 million.”

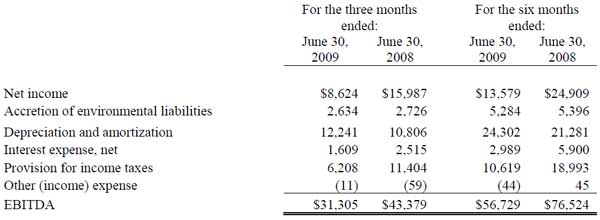

Non-GAAP Second-Quarter Results

Clean Harbors reports EBITDA results, which are non-GAAP financial measures, as a complement to results provided in accordance with accounting principles generally accepted in the United States (GAAP) and believes that such information provides additional useful information to investors since the Company’s loan covenants are based upon levels of EBITDA achieved. The Company defines EBITDA in accordance with its existing credit agreement, as described in the following reconciliation showing the differences between reported net income and EBITDA for the second quarter and first six months of 2009 and 2008 (in thousands):

Segment Reporting

In connection with the closing of the Eveready acquisition, the Company will be re-aligning and expanding its operating reporting segments. This new structure reflects the way management will make operating decisions and manage the growth and profitability of the business. Under the new structure, the Company intends to report its business in four operating segments, including:

| | Technical Services – provide a broad range of hazardous material management services including the packaging, collection, transportation, treatment and disposal of hazardous and non-hazardous waste at company owned incineration, landfill, wastewater, and other treatment facilities. | ||

| | Field Services – provide a wide variety of environmental cleanup services on customer sites or other locations on a scheduled or emergency response basis including tank cleaning, decontamination, remediation, and spill cleanup. | ||

| | Industrial Services – provide industrial and specialty services, such as high-pressure and chemical cleaning, catalyst handling, decoking, material processing and industrial lodging services to refineries, chemical plants, pulp and paper mills, and other industrial facilities | ||

| | Exploration Services – provide exploration and directional boring services to the energy sector serving oil and gas exploration, production, and power generation. |

Recent Financing Developments

On July 24, 2009, Clean Harbors repaid its $30.0 million term loan, which was due in 2010. On July 31, 2009, Clean Harbors discharged its $23.0 million of remaining outstanding senior secured notes by calling such notes for redemption on August 31, 2009 and depositing with the trustee the redemption price of $23.7 million and accrued interest of $0.3 million through the redemption date. On July 31, 2009, Clean Harbors also replaced its previous revolving credit and synthetic letter of credit facilities with a new revolving credit facility which will allow the Company to borrow or obtain letters of credit for up to $120.0 million (with a $110.0 million sub-limit for letters of credit).

Business and Financial Outlook

Based on the Company’s first-half performance and current market conditions, exclusive of the Eveready acquisition and related costs, Clean Harbors expects full-year 2009 revenues in the range of $925 million to $950 million, and EBITDA in the range of $143 million to $150 million. Previously, the Company had projected 2009 revenue growth to be flat to slightly down, compared with $1.03 billion in 2008, and 2009 EBITDA in the range of $163 million to $167 million.

Although Eveready’s financial statements for the first half of 2009 are not yet available, Eveready estimates that for the first half of 2009 it generated revenue of $232 million compared with $325 million in the first half of 2008, and EBITDA for the first half of 2009 of between $29 million and $30 million compared with approximately $55 million in the first half of 2008. The average exchange rate used to calculate revenue and EBITDA for 2009: CAN $1 equals approximately USD $0.83. The average exchange rate used to calculate revenue and EBITDA for 2008: CAN $1 equals approximately USD $0.99.

Based on the closing of the Eveready acquisition, financial results for the first half of 2009, and current market conditions, Clean Harbors expects full-year 2009 revenue for the combined company in the range of $1.13 billion to $1.16 billion, and full-year 2009 EBITDA in the range of $173 million to $180 million, inclusive of a five-month contribution from Eveready.

Assuming that the Eveready acquisition had been consummated on January 1, 2009, but without giving effect to any synergies, Clean Harbors estimates full-year 2009 revenue for the combined company would have been in the range of $1.41 billion to $1.44 billion, and pro forma full-year 2009 EBITDA would have been in the range of $211 million to $218 million.

In connection with its acquisition of Eveready, Clean Harbors has agreed to dispose of its interest in Eveready’s Pembina Area Landfill, located near Drayton Valley, Alberta, due to its proximity to Clean Harbors’ existing landfill in the region. The Pembina landfill represented less than two percent of Eveready’s revenue in 2008 and less than four percent of Eveready’s EBITDA for the year.

“We expect the Eveready acquisition to greatly benefit Clean Harbors in 2010 and beyond,” said McKim. “We expect to see a rebound in many of our end markets in the coming year and an improvement in our project business, which will ultimately drive volumes to our network of disposal facilities. We anticipate demand for industrial maintenance and production, lodging, and exploration services to increase in 2010 from 2009 levels. We are targeting approximately $15 million in cost synergies in 2010 through reductions in redundant headcount, economies of scale in procurement and the implementation of our back-office systems and processes.”

“We believe that the Eveready acquisition will be a long-term growth engine for Clean Harbors,” McKim said. “Not only does this transaction expand our footprint, but it provides us with valuable new resources in some of our end-markets. With the closing now behind us, we look forward to completing the integration process, introducing our world-class brand to new customers and driving top- and bottom-line improvements at the newly expanded Clean Harbors in the quarters ahead.”

Conference Call Information

Clean Harbors will conduct a conference call for investors to discuss the information contained in this press release today, Monday, August 3, 2009 at 9:00 a.m. (ET). On the call, Chairman, President and Chief Executive Officer Alan S. McKim and Executive Vice President and Chief Financial Officer James M. Rutledge will discuss the closing of the Eveready acquisition and Clean Harbors’ financial results, business outlook and growth strategy.

Investors who wish to listen to the webcast should log onto www.cleanharbors.com/investor_relations. The live call also can be accessed by dialing 877.407.5790 or 201.689.8328 prior to the start of the call. If you are unable to listen to the live call, the webcast will be archived on the Company’s website.

About Clean Harbors

Clean Harbors is North America’s leading provider of environmental, energy and industrial services serving over 50,000 customers, including a majority of the Fortune 500 companies, thousands of smaller private entities and numerous federal, state and local governmental agencies.

Within Clean Harbors Environmental Services, the Company offers Technical Services and Field Services. Technical Services provide a broad range of hazardous material management and disposal services including the collection, packaging, recycling, treatment and disposal of hazardous and non-hazardous waste. Field Services provide a wide variety of environmental cleanup services on customer sites or other locations on a scheduled or emergency response basis.

Within Clean Harbors Energy and Industrial Services, the Company offers Industrial Services and Exploration Services. Industrial Services provide industrial and specialty services, such as high-pressure and chemical cleaning, catalyst handling, decoking, material processing and industrial lodging services to refineries, chemical plants, pulp and paper mills, and other industrial facilities. Exploration Services provide exploration and directional boring services to the energy sector serving oil and gas exploration, production, and power generation.

Headquartered in Norwell, Massachusetts, Clean Harbors has more than 175 locations, including over 50 waste management facilities, throughout North America in 37 U.S. states, seven Canadian provinces, Mexico and Puerto Rico. The Company also operates international locations in Bulgaria, China, Sweden, Singapore, Thailand and the United Kingdom. For more information, visit www.cleanharbors.com.

Safe Harbor Statement

Any statements contained herein that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. These forward-looking statements are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements may include, but are not limited to, statements about the benefits of the acquisition of Eveready, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Clean Harbors’ management and are subject to significant risks and uncertainties. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. The Company undertakes no obligation to revise or publicly release the results of any revision to these forward-looking statements other than through its various filings with the Securities and Exchange Commission. A variety of factors may affect the Company’s performance, including, but not limited to:

- The Company’s ability to successfully integrate Eveready’s operations and assets into the Company’s existing operations and assets;

- The Company’s ability to manage the significant environmental liabilities that it assumed in connection with prior acquisitions;

- The availability and costs of liability insurance and financial assurance required by governmental entities related to the Company’s facilities;

- General conditions in the oil and gas industries, particularly in the Alberta oil sands and other parts of Western Canada;

- The possibility that the expected synergies from the acquisition of Eveready will not be realized at the time they are projected to or at all;

- The extent to which the Company’s and Eveready’s major customers commit to and schedule major projects;

- The Company’s future cash flow and earnings;

- The Company’s ability to meet its debt obligations;

- The Company’s ability to increase its and Eveready’s market shares;

- The Company’s ability to retain its and Eveready’s significant customers;

- The effects of general economic conditions in the United States, Canada and other territories and countries where the Company does business;

- The effect of economic forces and competition in specific marketplaces where the Company competes;

- The possible impact of new regulations or laws pertaining to all activities of the Company’s operations;

- The outcome of litigation or threatened litigation or regulatory actions;

- The effect of commodity pricing on overall revenues and profitability;

- Possible fluctuations in quarterly or annual results or adverse impacts on the Company’s results caused by the adoption of new accounting standards or interpretations or regulatory rules and regulations;

- The effect of weather conditions or other aspects of the forces of nature on field or facility operations;

- The effects of industry trends in the environmental services, waste handling and industrial services marketplaces; and

- The effects of conditions in the financial services industry on the availability of capital and financing.

Any of the above factors and numerous others not listed nor foreseen may adversely impact the Company’s financial performance. Additional information on the potential factors that could affect the Company’s actual results of operations is included in its filings with the Securities and Exchange Commission, which may be viewed on www.cleanharbors.com/investor_relations.

Contacts

| Investor Relations Clean Harbors, Inc. 781.792.5100 InvestorRelations@cleanharbors.com |

Jim Buckley Executive Vice President Sharon Merrill Associates, Inc. 617.542.5300 clhb@investorrelations.com |

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(in thousands except per share amounts)

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

ASSETS

(in thousands)

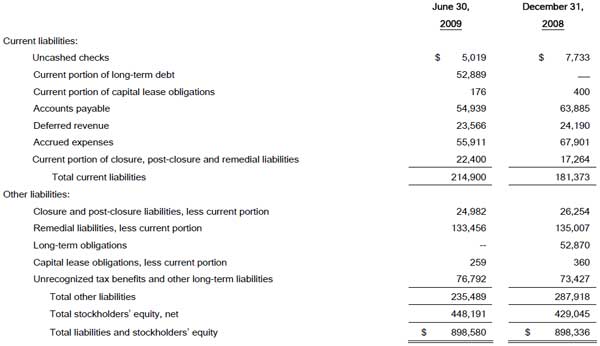

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

LIABILITIES AND STOCKHOLDERS’ EQUITY

(in thousands)