Clean Harbors Reports Record Second-Quarter 2010 Financial Results

| | Company Achieves Record Revenue of $472 Million and EBITDA of $96.6 Million | ||

| | Strong Contributions Across Segments and Gulf Spill Response Drive Performance | ||

| | Groundbreaking Begins on New Energy and Industrial Facility in Alberta Region | ||

| | Company Updates 2010 Guidance |

Norwell, MA – August 4, 2010 – Clean Harbors, Inc. (“Clean Harbors”) (NYSE: CLH), the leading provider of environmental, energy and industrial services and hazardous waste management services throughout North America, today announced financial results for the second quarter ended June 30, 2010.

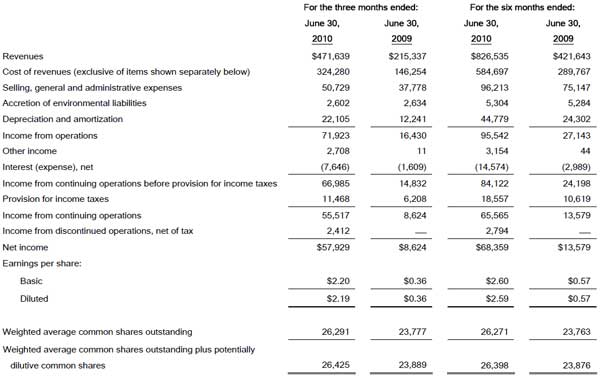

Revenues more than doubled to $471.6 million from $215.3 million in the second quarter of 2009, reflecting the acquisition of Eveready Inc. in mid-2009, a strong performance in the legacy Clean Harbors’ business and its response to the Gulf of Mexico oil spill. Income from operations increased to $71.9 million from $16.4 million in the second quarter of 2009.

Second quarter 2010 net income grew to $57.9 million, or $2.19 per diluted share, from $8.6 million, or $0.36 per diluted share, in the second quarter of 2009. Due to a favorable release of unrecognized tax benefits, the effective tax rate for the second quarter of 2010 was 17%, compared with 42% in the second quarter of 2009. Second quarter 2010 net income also included: a favorable change in the estimate for environmental liabilities of $3.1 million on a pre-tax basis; other income of $2.7 million, on a pre-tax basis, resulting from gains on the sale of fixed assets and marketable securities; and $2.4 million in income from discontinued operations, net of tax, primarily from the sale of assets held for sale. Second quarter 2009 net income included approximately $3.3 million in expenses related to the Company’s acquisition of Eveready. Weighted average diluted shares outstanding used to calculate net income per share in the second quarter of 2010 were 26.4 million, versus 23.9 million in the same period of 2009.

EBITDA (see description below) more than tripled to $96.6 million from $31.3 million in the second quarter of 2009.

Comments on the Second Quarter

“The second quarter of 2010 was a milestone quarter for Clean Harbors, as we generated revenue of more than $470 million and achieved record profits and EBITDA,” said Alan S. McKim, Chairman and Chief Executive Officer. “Our results in the quarter were driven by the combination of our oil spill response in the Gulf of Mexico and an excellent performance across nearly all of our operating segments. Within our Technical Services business, incineration utilization for the quarter exceeded 91%, compared with 88% in the same period of 2009, while landfill volumes increased 17% year-over-year. For our Technical Services and Field Services segments, we saw strong contributions within a number of our key industry verticals including Chemicals, Manufacturing, Utilities and Government. Although the second quarter is historically the seasonally weakest period for Industrial Services, this segment exhibited healthy momentum fueled by growth in Western Canada and the refinery industry in particular.”

“Our participation in the Gulf oil spill response exceeded our initial expectations and the guidance we provided in mid-May, accounting for more than 20% of revenue in the second quarter,” McKim said. “We worked closely with both government agencies and private organizations to provide a broad range of services within four primary areas: skimming, decontamination, water treatment and onshore clean-up. We deployed a large number of our own employees in the region and hired subcontractors who recruited a temporary workforce from the affected areas. At the peak level in the quarter, we had more than 3,500 response-related personnel in the Gulf region. We also supplied a wide variety of equipment, including boats, containment boom, skimmers, and vacuum trucks, as well as recovery and treatment systems.”

“During the quarter, we made substantial progress on our integration efforts with Eveready,” McKim said. “Early in the quarter, we successfully divested the Pembina Area Landfill for $11.7 million and another non-core asset for $2.4 million. We continued with our rebranding program, which should be complete by the end of the third quarter. We also reallocated some of Eveready’s extensive fleet of assets to further improve equipment utilization, including shifting dozens of trucks and specialized vehicles to the U.S., some of which were involved in the Gulf clean-up efforts. We continue to roll out new, enhanced systems to simplify the administration of the oil field services line of business.”

Non-GAAP Second-Quarter Results

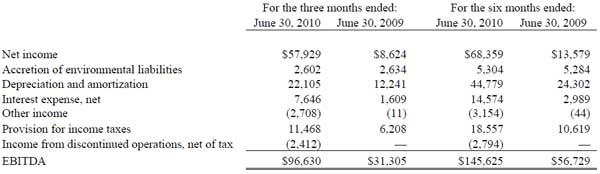

Clean Harbors reports EBITDA results, which are non-GAAP financial measures, as a complement to results provided in accordance with accounting principles generally accepted in the United States (GAAP) and believes that such information provides additional useful information to investors since the Company’s loan covenants are based upon levels of EBITDA achieved. The Company defines EBITDA in accordance with its existing credit agreement, as described in the following reconciliation showing the differences between reported net income and EBITDA for the second quarter and first six months of 2010 and 2009 (in thousands):

Business Outlook and Financial Guidance

“We concluded the first half of the year with a strong cash position of nearly $300 million that will enable us to accelerate our growth through selective acquisitions and strategic investments,” McKim said. “Our acquisition pipeline remains healthy and we are continuing to evaluate a number of strategic opportunities. On the internal front, we are broadening our presence in the Ruth Lake region, north of Ft. McMurray, Alberta. We are building a $25 million facility consisting of a new Energy and Industrial service location, a 400-bed open camp, a training facility and maintenance shops. We are excited about the potential for this integrated facility, which will become the Company’s northernmost service location in Alberta and provide us with a greater presence in this attractive market. Site preparation for the location is already underway and we anticipate opening the first phase – a 200-bed camp and training facility – by year-end.”

“As we enter the second half of 2010, we are optimistic about our prospects for the full year,” McKim said. “While the North American economy has yet to fully recover from the recession, we continue to see stabilization and improved performance across the majority of our key end markets. We remain encouraged by the combination of sizeable project opportunities in our pipeline and the outlook for routine maintenance and remediation work within our verticals. In addition, we expect our Gulf response-related activities to continue in the current quarter at a reduced level before winding down to significantly lower levels in the fourth quarter.”

“Within our core business, we intend to leverage our extensive network of assets to continue to grow our EBITDA at a greater pace than our revenues. Our ongoing cost reduction initiatives have proven to be highly successful. As we further integrate Eveready, we expect to gain increased efficiencies from those assets. Overall, we remain on track to capture the $15 million in synergies we are targeting for Eveready in 2010,” McKim concluded.

Based on year-to-date performance, current market conditions and the impact of the emergency response event in the Gulf, Clean Harbors is revising its 2010 annual revenue and EBITDA guidance, exclusive of potential future acquisitions. The Company currently expects full-year 2010 revenue in the range of $1.6 billion to $1.65 billion, which includes anticipated revenues related to the Gulf oil spill through the third quarter. The Company is now targeting EBITDA for 2010 in the range of $270 million to $280 million for the full year.

Conference Call Information

Clean Harbors will conduct a conference call for investors to discuss the information contained in this press release today, Wednesday, August 4, 2010 at 9:00 a.m. (ET). On the call, Chairman, President and Chief Executive Officer Alan S. McKim and Executive Vice President and Chief Financial Officer James M. Rutledge will discuss Clean Harbors’ financial results, business outlook and growth strategy.

Investors who wish to listen to the second-quarter 2010 webcast should log onto www.cleanharbors.com/investor_relations. The live call also can be accessed by dialing 877.709.8155 or 201.689.8881 prior to the start of the call. If you are unable to listen to the live call, the webcast will be archived on the Company’s website.

About Clean Harbors

Clean Harbors is the leading provider of environmental, energy and industrial services and hazardous waste management services throughout North America. The Company serves more than 50,000 customers, including a majority of the Fortune 500 companies, thousands of smaller private entities and numerous federal, state, provincial and local governmental agencies.

Within Clean Harbors Environmental Services, the Company offers Technical Services and Field Services. Technical Services provide a broad range of hazardous material management and disposal services including the collection, packaging, recycling, treatment and disposal of hazardous and non-hazardous waste. Field Services provide a wide variety of environmental cleanup services on customer sites or other locations on a scheduled or emergency response basis.

Within Clean Harbors Energy and Industrial Services, the Company offers Industrial Services and Exploration Services. Industrial Services provide industrial and specialty services, such as high-pressure and chemical cleaning, catalyst handling, decoking, material processing and industrial lodging services to refineries, chemical plants, pulp and paper mills, and other industrial facilities. Exploration Services provide exploration and directional boring services to the energy sector serving oil and gas exploration, production, and power generation.

Safe Harbor Statement

Any statements contained herein that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. These forward-looking statements are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements may include, but are not limited to, statements about the benefits of the acquisition of Eveready, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Clean Harbors’ management and are subject to significant risks and uncertainties. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. The Company undertakes no obligation to revise or publicly release the results of any revision to these forward-looking statements other than through its various filings with the Securities and Exchange Commission. A variety of factors may affect the Company’s performance, including, but not limited to:

- The Company’s ability to manage the significant environmental liabilities that it assumed in connection with prior acquisitions;

- The availability and costs of liability insurance and financial assurance required by governmental entities related to the Company’s facilities;

- General conditions in the oil and gas industries, particularly in the Alberta oil sands and other parts of Western Canada;

- The possibility that the expected synergies from the acquisition of Eveready will not be timely or fully realized;

- The extent to which the Company’s major customers commit to and schedule major projects;

- The occurrence of events such as the recent Gulf spill, which require cleanup and other services;

- The Company’s future cash flow and earnings;

- The Company’s ability to meet its debt obligations;

- The Company’s ability to increase its market share;

- The effects of general economic conditions in the United States, Canada and other territories and countries where the Company does business;

- The effect of economic forces and competition in specific marketplaces where the Company competes;

- The possible impact of new regulations or laws pertaining to all activities of the Company’s operations;

- The outcome of litigation or threatened litigation or regulatory actions;

- The effect of commodity pricing on overall revenues and profitability;

- Possible fluctuations in quarterly or annual results or adverse impacts on the Company’s results caused by the adoption of new accounting standards or interpretations or regulatory rules and regulations;

- The effect of weather conditions or other aspects of the forces of nature on field or facility operations;

- The effects of industry trends in the environmental services, energy and industrial services marketplaces; and

- The effects of conditions in the financial services industry on the availability of capital and financing.

Any of the above factors and numerous others not listed nor foreseen may adversely impact the Company’s financial performance. Additional information on the potential factors that could affect the Company’s actual results of operations is included in its filings with the Securities and Exchange Commission, which may be viewed on www.cleanharbors.com/investor_relations.

Contacts

| Investor Relations Clean Harbors, Inc. 781.792.5100 InvestorRelations@cleanharbors.com |

Jim Buckley Executive Vice President Sharon Merrill Associates, Inc. 617.542.5300 clhb@investorrelations.com |

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(in thousands except per share amounts)

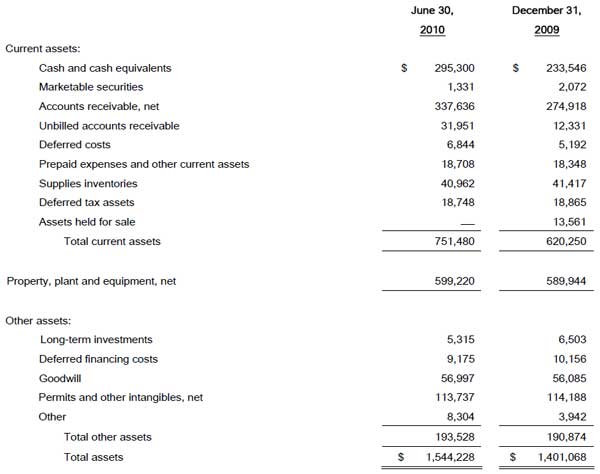

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

ASSETS

(in thousands)

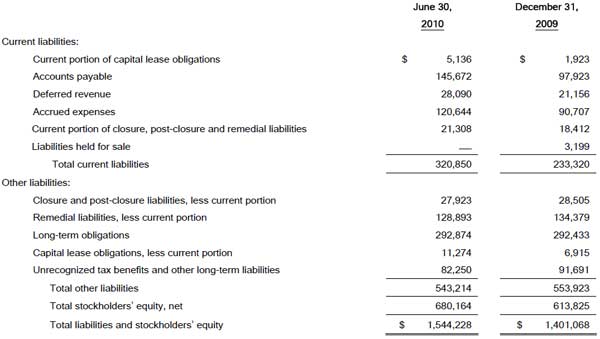

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

LIABILITIES AND STOCKHOLDERS’ EQUITY

(in thousands)